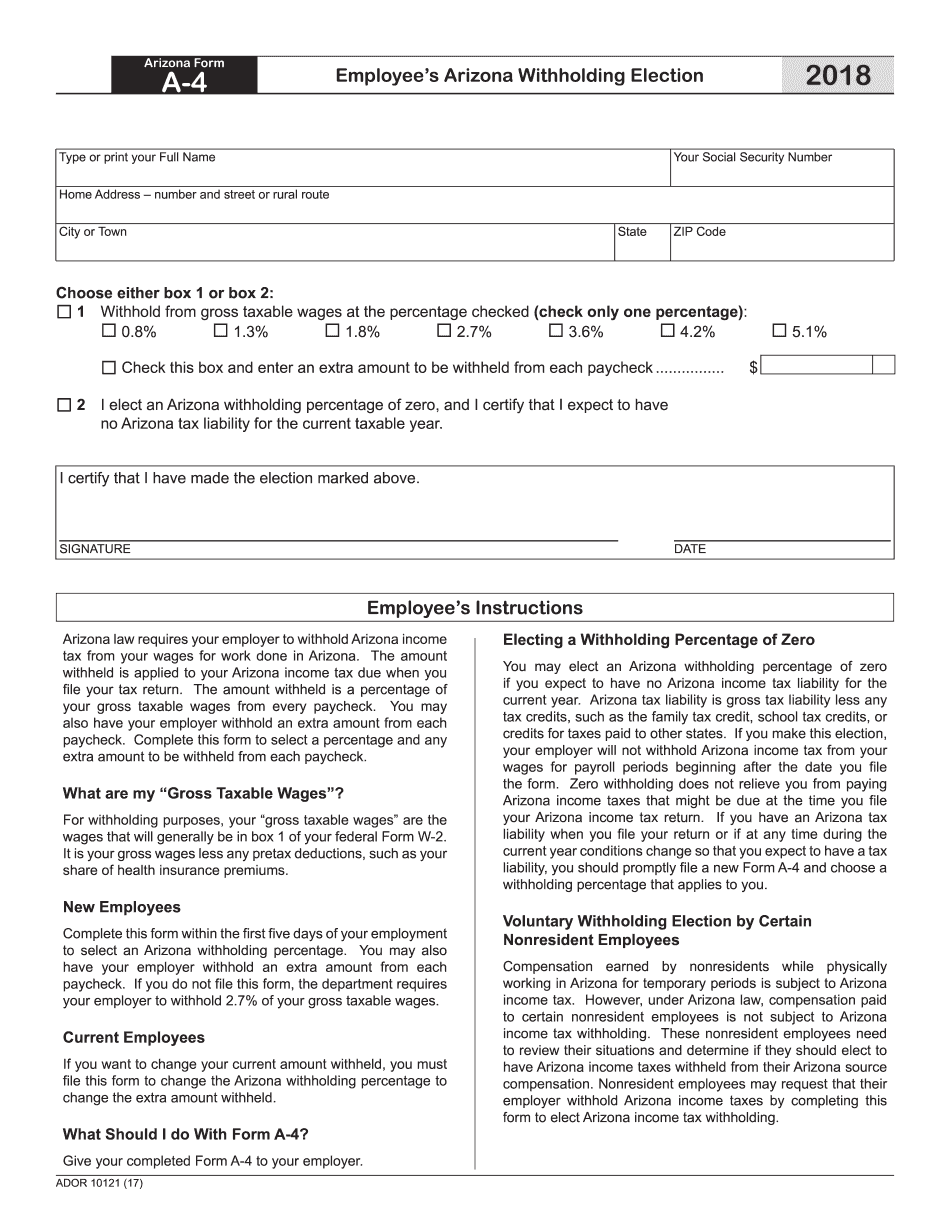

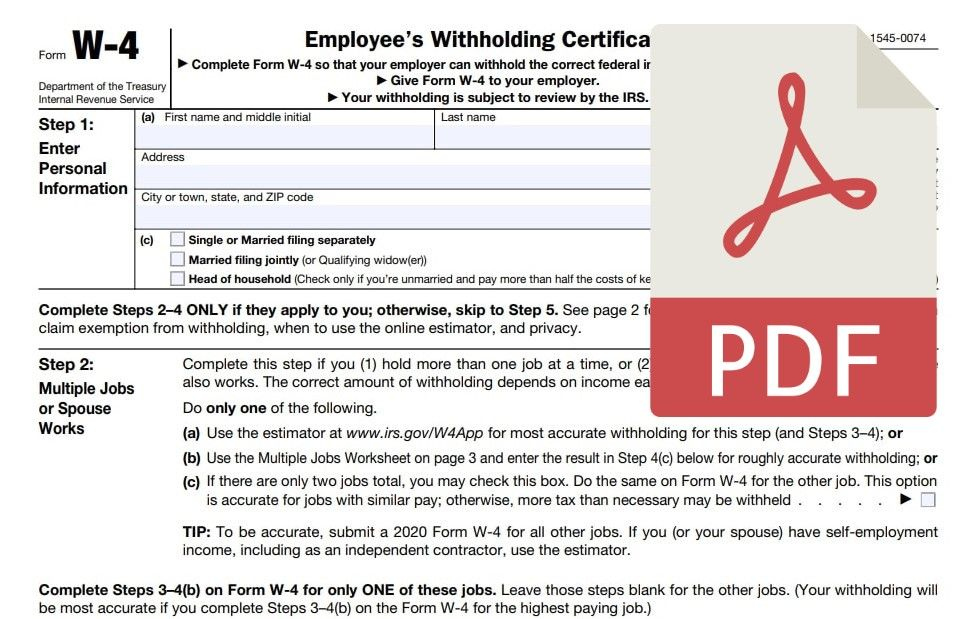

Az W 4 Form 2024. 2023 arizona form a4 requirements for employee state income tax withholding. In addition to the federal income tax withholding form, w4, each employee needs to fill out an.

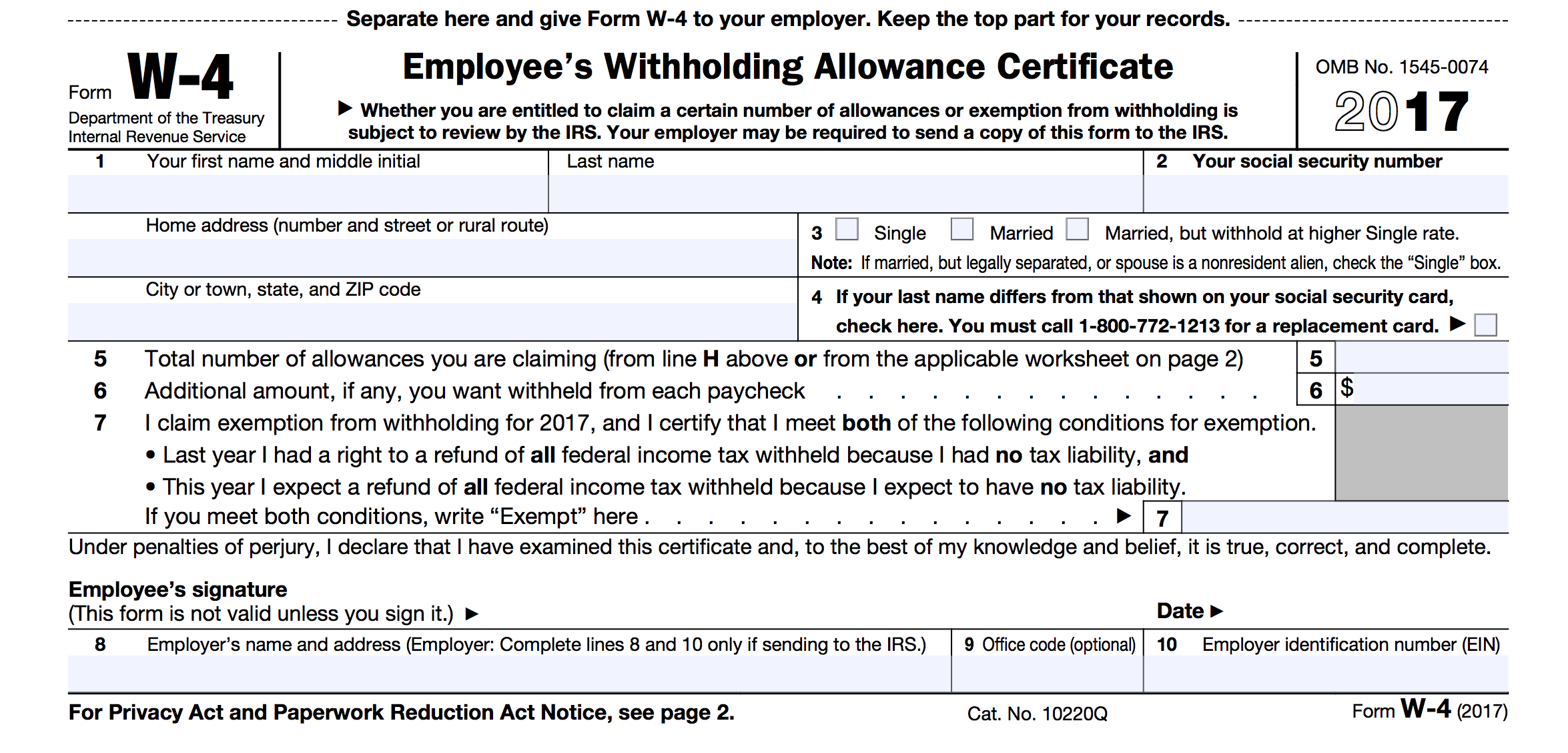

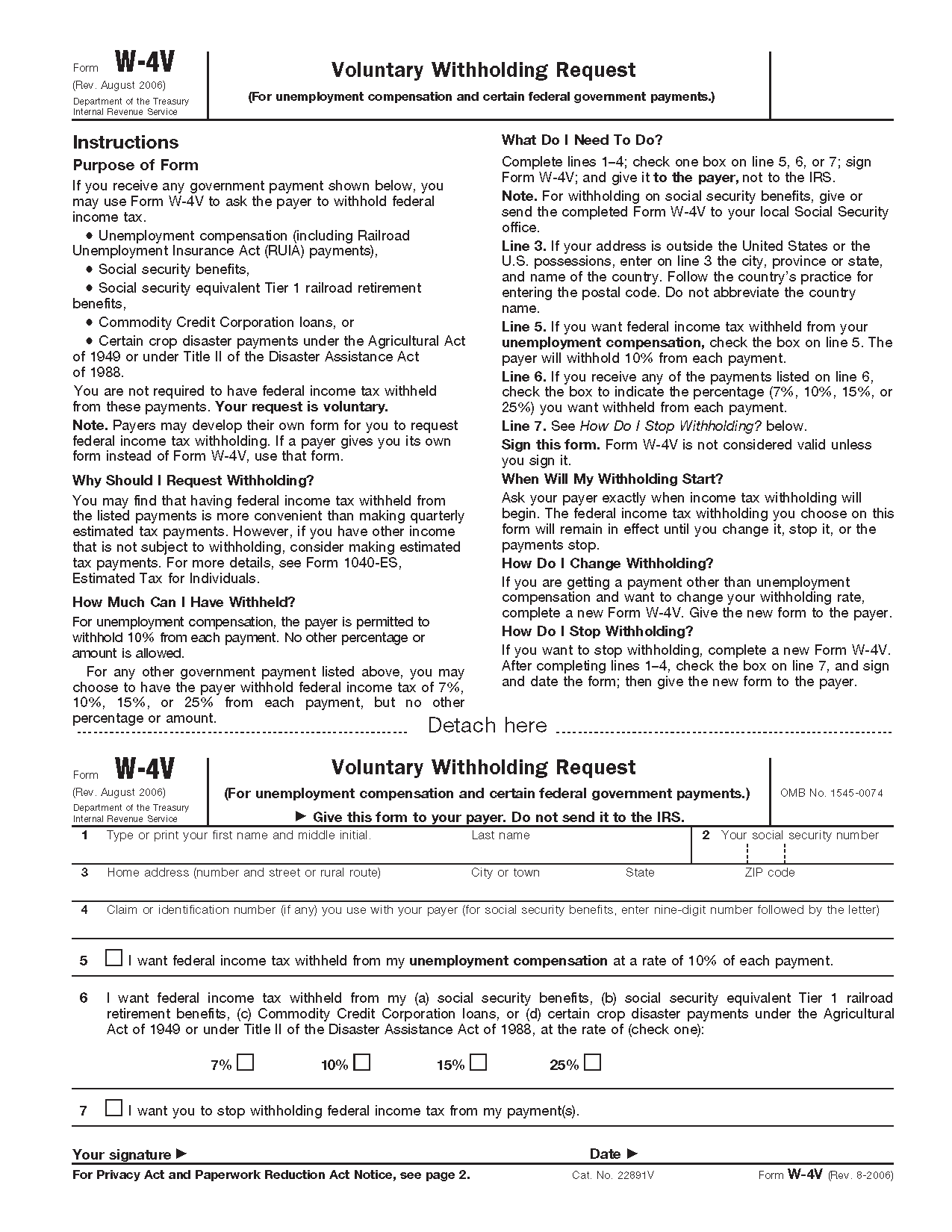

Fortunately, there is a very simple form to help each employer determine that. Instructions for using the irs’s tax withholding estimator when figuring withholding for multiple.

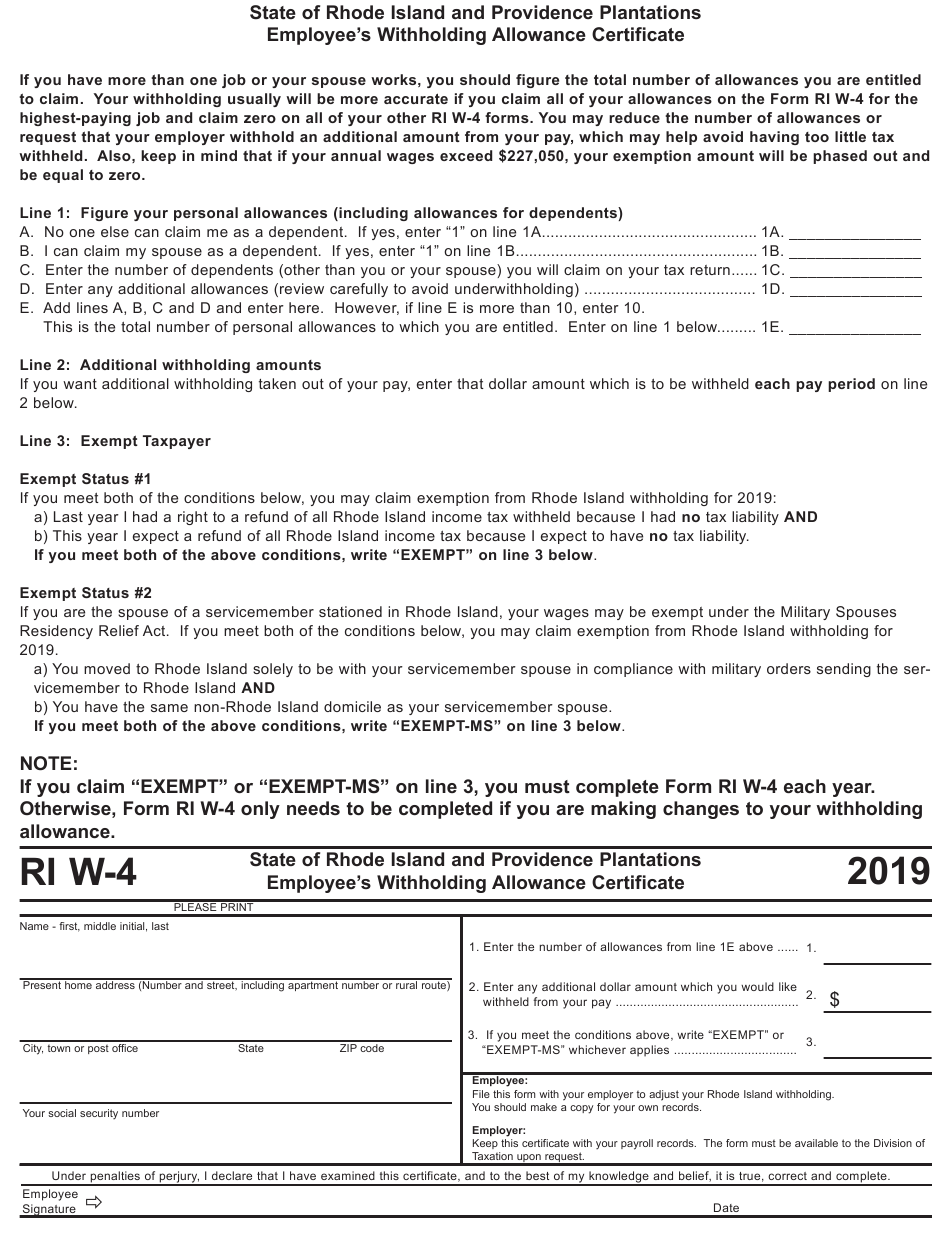

This Includes The Requirements For Completing The Form Properly, Handling Non.

To compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding must.

20 Rows Withholding Returns Must Be Filed Electronically For Taxable Years Beginning From And.

You can use your results from the.

Az W 4 Form 2024 Images References :

Source: noraqvalaree.pages.dev

Source: noraqvalaree.pages.dev

Is There A New W 4 Form For 2024 Lacie AnnaDiana, 2023 arizona form a4 requirements for employee state income tax withholding. 20 rows withholding returns must be filed electronically for taxable years beginning from and.

Source: miquelawfarah.pages.dev

Source: miquelawfarah.pages.dev

Irs Form W4 2024 Fillable Chere Myrtice, Employees who expect no arizona income tax liability for the calendar year may claim an. Prior to 2020, workers claimed allowances on the form to determine tax withholdings from.

Source: w4-form-2018-printable.com

Source: w4-form-2018-printable.com

Arizona A4 Form 2024 Printable AZ W4 Form, Keep a copy for your records. In addition to the federal income tax withholding form, w4, each employee needs to fill out an.

Source: kristanwmae.pages.dev

Source: kristanwmae.pages.dev

W4 Form 2024 Pdf Fillable Emmi Norine, 2023 arizona form a4 requirements for employee state income tax withholding. To compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding must.

Source: anabellawelaine.pages.dev

Source: anabellawelaine.pages.dev

2024 W4 Forms Irs Ester Janelle, Prior to 2020, workers claimed allowances on the form to determine tax withholdings from. 2023 arizona form a4 requirements for employee state income tax withholding.

Source: brigittawilyssa.pages.dev

Source: brigittawilyssa.pages.dev

Irs Form W4 2024 Printable Berti Chandal, Employees who expect no arizona income tax liability for the calendar year may claim an. This includes the requirements for completing the form properly, handling non.

Source: sandylilith.pages.dev

Source: sandylilith.pages.dev

W4 2024 Form Irs Billye Melesa, 20 rows withholding returns must be filed electronically for taxable years beginning from and. Fortunately, there is a very simple form to help each employer determine that.

Source: ashlenqmaryrose.pages.dev

Source: ashlenqmaryrose.pages.dev

W 4 Form 2024 Printable Pdf Download channa chelsey, Employees who expect no arizona income tax liability for the calendar year may claim an. It’s available in several different languages.

Source: www.efile.com

Source: www.efile.com

Create Your W4 Form Now. Sign and eFile Your Form Now, Keep a copy for your records. Instructions for using the irs’s tax withholding estimator when figuring withholding for multiple.

Source: martellewgennie.pages.dev

Source: martellewgennie.pages.dev

W4 Form 2024 Fillable Ashely, To compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding must. Employees who expect no arizona income tax liability for the calendar year may claim an.

Residents Who Receive Regularly Scheduled Payments From Payments Or Annuities Complete This Form To Elect To Have Arizona Income Taxes Withheld From Their Payments.

It’s available in several different languages.

To Compute The Amount Of Tax To Withhold From Compensation Paid To Employees For Services Performed In Arizona, All New Employees Subject To Arizona Income Tax Withholding Must.

It tells the employer how much to withhold from an employee’s paycheck for taxes.

Category: 2024